Ticker Talk AI

Stock AI Research Tool

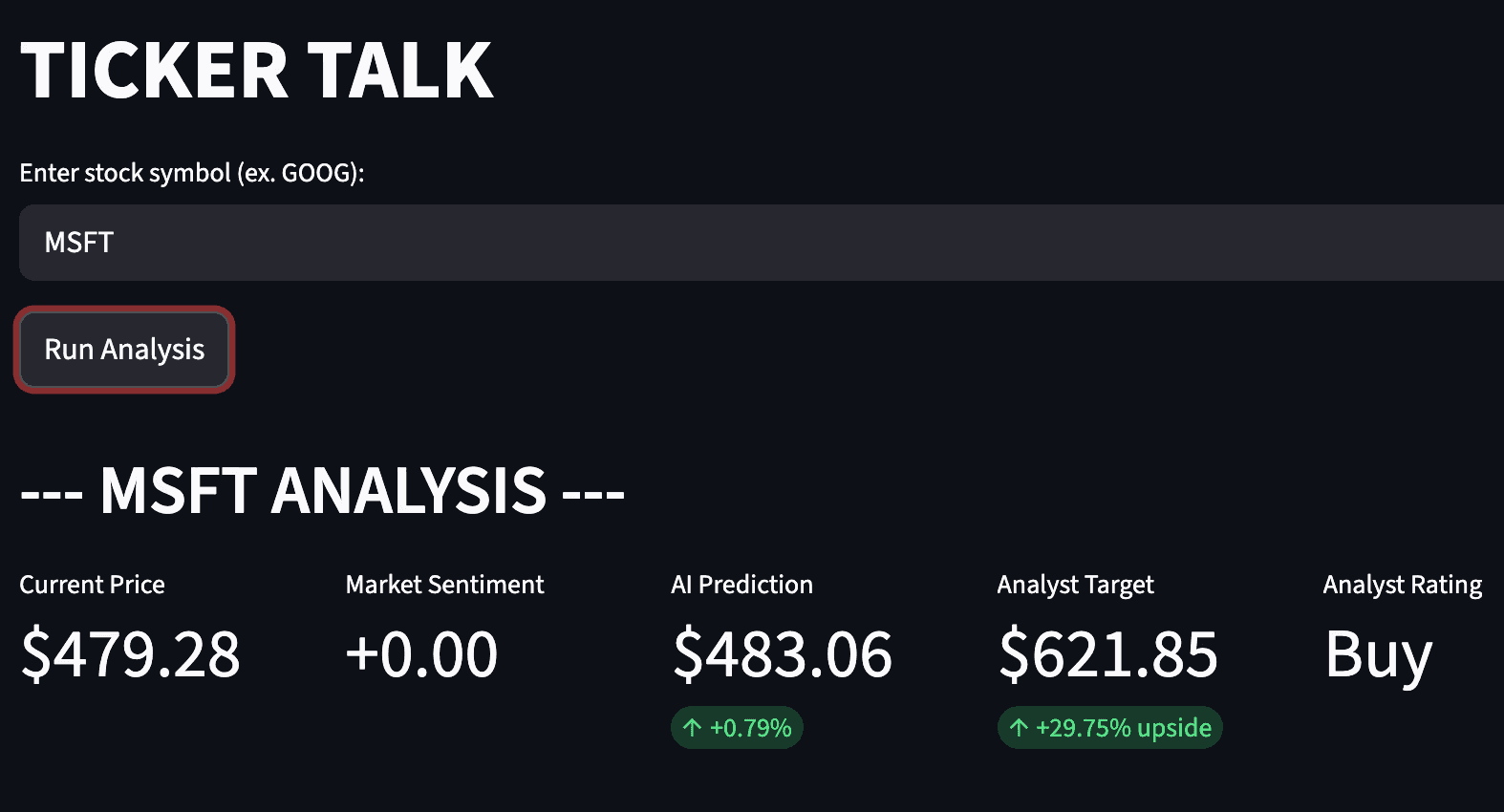

I built Ticker Talk AI because I was tired of jumping between five different tabs just to research one stock. It pulls together real-time prices, analyst targets, and ratings into one dashboard, then runs the data through an AI-driven mathematical model I built for price predictions. This tool significantly cuts down the research time allowing users to get the infomration they need in seconds.

Personal Project/Open Source

FinTech/Artificial Intelligence/Machine Learning/Data Science

Data Analysis and Visualization

December 2025

The Build

Real-Time Data Engine: I integrated multiple financial APIs like Finnhub and Alpha Vantage to pull live prices and analyst targets. To keep the app snappy and avoid hitting API limits, I implemented a triple-layer failover system and used Streamlit caching to store data for 10-minute intervals.

Predictive Modeling: Instead of just showing historical data, I built a linear regression model using Scikit-Learn to project the next day’s closing price. It calculates a "safety zone" based on volatility so users can see the potential risk alongside the prediction.

Sentiment Analysis: I developed a custom logic that scans recent news headlines for bullish or bearish keywords. It turns raw news into a numerical score, helping to gauge the market "vibe" before you even read the articles.

Design & Logic

Interactive Visuals: I used Matplotlib to create custom charts that overlay my AI’s trendlines and predictions directly on top of the actual stock price, making the technical analysis easy to see at a glance.

The Verdict System: I designed a scoring algorithm that weighs news sentiment, AI predictions, and analyst ratings to give a final "Strong Buy" to "Sell" verdict. It’s built to give a clear, data-backed answer instead of just a wall of numbers.

What I Used:

Python & Streamlit: Built the core application logic and a high-performance web dashboard for real-time data visualization.

Machine Learning (Scikit-Learn): Implemented a Linear Regression model to predict the next day's closing price based on historical trends.

Financial APIs (Finnhub & Alpha Vantage): Integrated multiple data streams for real-time stock prices, analyst price targets, and recommendation ratings.

Natural Language Processing (NewsAPI): Developed a sentiment analysis engine that scores recent news headlines to gauge market mood.

Multi-Layer Failover System: Engineered a robust data retrieval system using

yfinanceas a fallback to ensure reliability when primary API limits are reached.Data Visualization (Matplotlib): Designed interactive charts featuring historical prices, AI-generated trendlines, and volatility "safety zones".